Features

- THE ODDSMAKER 2300

- THE ODDSMAKER S&P 500

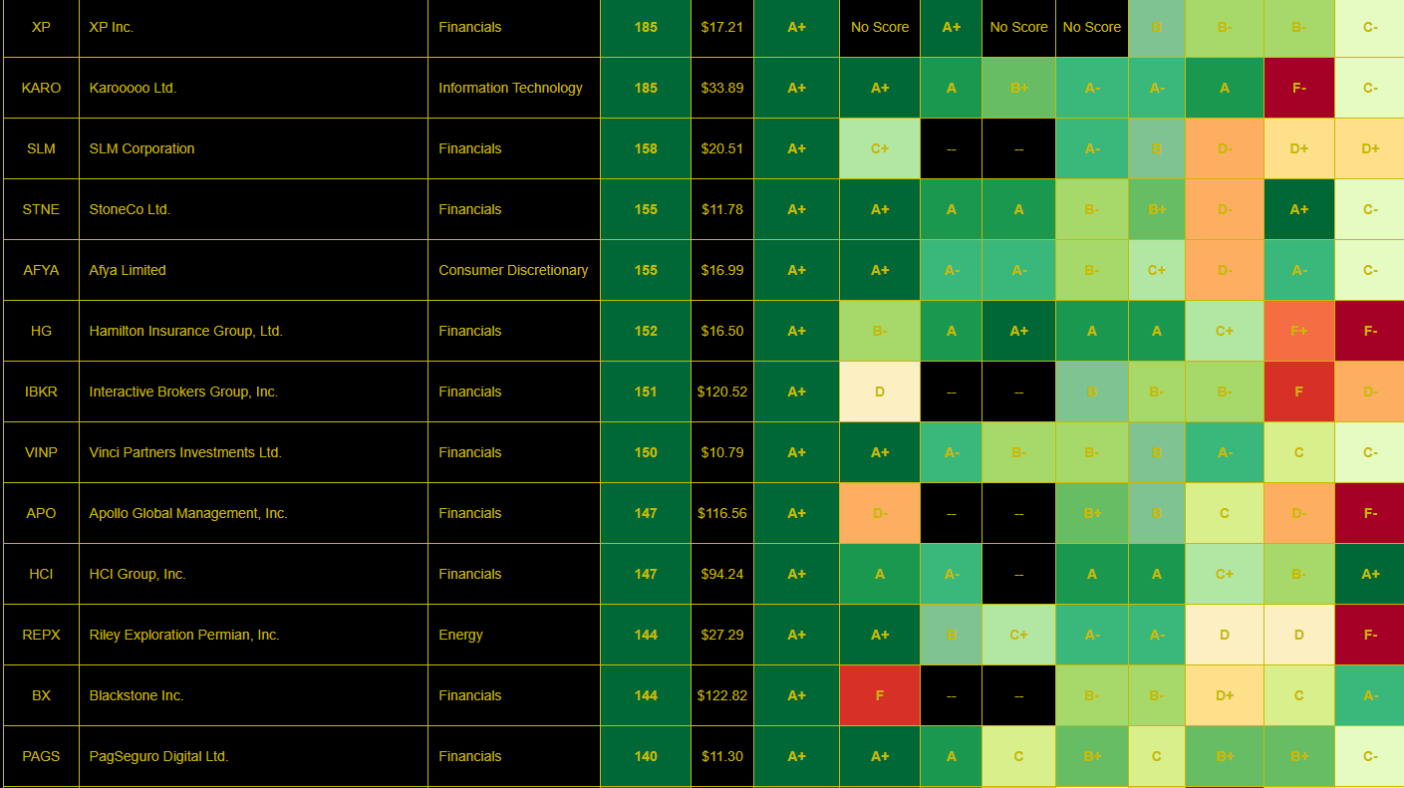

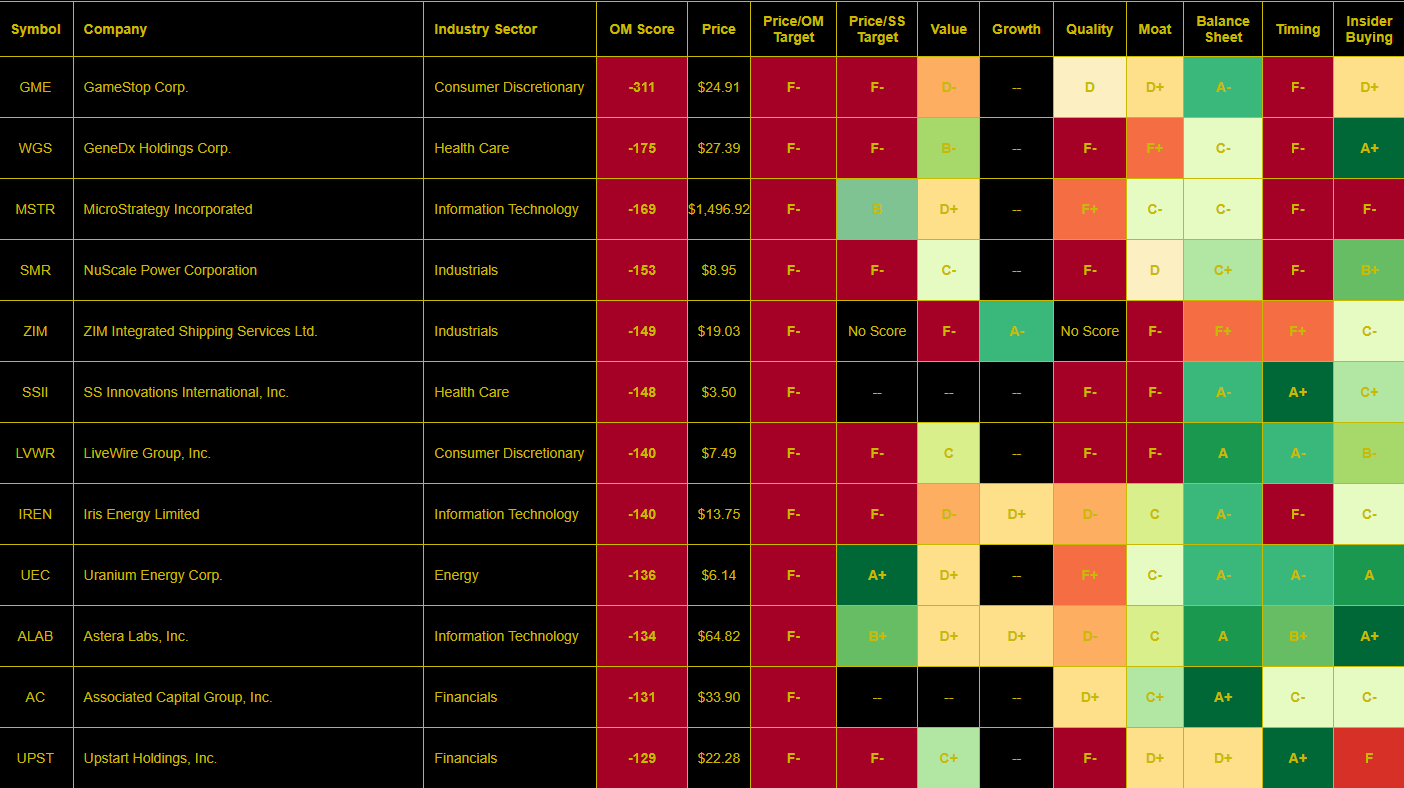

- ODDSMAKERS BEST & WORST BETS

- NO UPSIDE LIST

- STOCKS ORGANIZED RISK

- THE ODDSMAKER PRIVATE EQUITY TARGETS

- BERKSHIRE'S BRAIN

- LOVED, LIQUID, & LATE

- UNIVERSAL HATE, BUT GREAT

- LANDSLIDE RISK

- GOLDMINE + SAFETY NET

- MOST EXPENSIVE

- JUNK YARD

- TOP ODDSMAKERS FAVORITE LISTS

- HIGHEST FREE CASH FLOW YIELDS

- MOST HEAVILIY SHORTED STOCKS

- STOCKS WITH 100% UPSIDE TO SELL SIDE TARGETS

- LARGEST % SHARE REPURCHASERS

Same Measuring Stick For All Stocks

- Short interest

- Forward revenue growth

- Free cash flow margin

- Free cash flow multiple

- Return on invested capital

- Price/sales multiple

- Price/sell side target

- Share repurchase

- Cash flow analysis

- accounting flags

- Ev/ebitda

- JUNK YARD

- Cash flow analysis

- Proprietary scoring points

- Short squeeze points

- Trading dynamics scoring

- Outlier cross reference points

- Insider action scoring points

Ranked on Price/Value

- American Express

- Delta

- Berkshire Hathaway

- Best Bet Company A

- General Motors

- Las Vegas Sands

- Ford

- Wynn

- Johnson Controls

- Exxon Mobil

- Marathon Oil

- Goldman Sachs

- Airbnb

- Microsoft

- Autodesk

- Home Depot

- Amazon

- Netflix

Price

- $140

- $375

Value

- $210

- $407

%

- 50%

- 10%

Price is what you pay, value is what you get

– Warren E. Buffett

What People are Saying

Doug Dyer, CFA

- former analyst, portfolio manager, and prop desk trader

The Oddsmaker has nailed it when it comes to ranking stocks and determining intrinsic value with their multi-factor screening process. This substantially reduces the time I spend going through financials and trying to determine intrinsic values and rankings on my own. I can reallocate my time to trading and looking for optimal options strategies.

How does the Oddsmaker score data?

Our Oddmaker Platform is built on years of experience and success by analyzing, sorting & ranking data of key

drivers of equity value creation and destruction

Our data covers a mix of near real time factors, backwards looking results, forward looking estimates, and scores

roughly 2 million data points on both linear and non-linear scales to easily understanding price/value

relationships across stocks.

Our factors measure a mix of quality, value, growth, accounting, capital allocation, compounding trends, forward

estimates, trading dynamics, balance sheet, intrinsic value premium/discount, insider buying, & hidden assets.

We analyze data compared to all other stocks, which seeks to find stocks where investors are both more willing to

sell due to unfavorable price/value relationships & Stocks where investors may buy due to

favorable price/value relationships.

Our data levels the playing field by giving rookies to pros instant access to clearly understand where risks and

opportunitie lie in the stock market.

The Oddsmaker Brand

- We will constantly improve the platform and will constantly seek to make our service the very best price/value tool you use.

- We will stay humble believe the quote "All Models are Wrong, But Some are Useful"

- We will not hit every inflection point, stocks can stay significantly undervalued and overvalued for long periods of time

- Our Goal is to be extremely useful for investors to improve your odds of investing success by understanding risk through Price To Value

Instantly Understand Price Versus Value Relationships

Features

- THE ODDSMAKER 2300

- THE ODDSMAKER S&P 500

- ODDSMAKERS BEST & WORST BETS

Benefit

- Get a Mathmatical Best-Worst Ranking 2300 Stocks Every Week + OM Scoring Data

- Get a Mathmatical Best-Worst Ranking of the S&P 500 Each Week + OM Scoring Data

- Front lines from our team of expert investor on biggest risks and best bets in the market each week

Cost

- $59.99

- $59.99

- $59.99

Find Long & Short For Best Price/Value Opportunities

- THE ODDSMAKER PRIVATE EQUITY TARGETS

- THE ODDSMAKER S&P 500

- BERKSHIRE'S BRAIN

- LOVED, LIQUID, & LATE

- UNIVERSAL HATE, BUT GREAT

- LANDSLIDE RISK

- GOLDMINE + SAFETY NET

- MOST EXPENSIVE

- JUNK YARD

- TOP ODDSMAKERS FAVORITE LISTS

- Get both Stocks trading +95% of analyst targets + Oddsmaker Scoring Data

- Get both our Best Bets for Private Equity Acquisition + Oddsmaker Scoring Data

- Gain Insights to common investment traits of BRK and list of ideas + OM Scoring

- Get access to Wall Street Most Loved Stocks where downside could lurk +OM Scoring

- Get access to list of high quality and very inexpensively priced stocks + OM Scoring

- Gain Insights into where aggressive trading patterns are with lower quality businesses

- Get highest returns on capital, good balance sheet, low valuations + OM scoring

- Get access to low levels of profitability with top 10% equity valuation + OM Scroing

- Gain access to lsit of the highest 20% sales multiple and bottom 20% ROE

- The Oddsmaker Favorites Best of 40 weekly flags of highest value with OM Scoring

- $9.99

- $9.99

- $9.99

- $9.99

- $9.99

- $9.99

- $9.99

- $9.99

- $9.99

- $49.99

Launch Price

$12.99/ month

Special Launch Pricing For First 1000 Members!

The First 1000 Oddmaker Subscribers are Locked in at Launch Rate of Just $12.99 per Month

After 1000 Subscribers Monthly Rates Will Increase Substantially